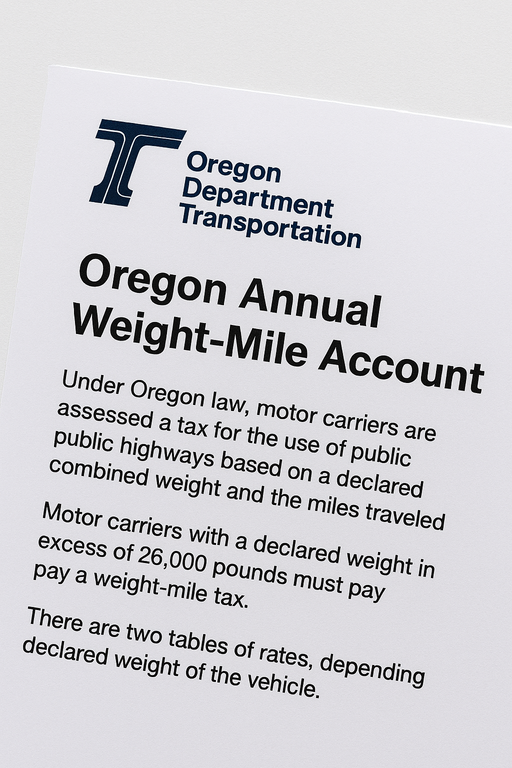

Annual Weight‑Mile Tax Permit

What it is

-

Under Oregon statute Oregon Revised Statutes § 825.474, motor carriers are assessed a tax for the use of public highways. The amount depends on the declared combined weight of the vehicle and the miles traveled in Oregon.

-

If a vehicle’s registered weight is over 26,000 pounds, it generally falls into the weight‑mile tax regime rather than just fuel tax.

-

The tax is based on:

-

A “declared weight” (maximum combination weight the carrier expects the vehicle to operate at)

-

The number of miles the vehicle travels on Oregon public highways.

-

How it works & key details

-

There are two tables of rates:

-

Table A applies to vehicles with declared weights between 26,001 lbs and 80,000 lbs.

-

Table B applies to vehicles declared above 80,000 lbs (up to 105,500 lbs) and considers axle configuration as well as weight.

-

-

Carriers must enroll in the program via www.oregontruckingonline.org

-

Carriers must track and report mileage in Oregon (origin/destination, miles in Oregon, route, etc). Recordkeeping rules state these must be retained for at least 3 years.

-

Some carriers (for specific commodity types like logs, sand/gravel, wood chips) can elect to pay a flat annual fee instead of the per‑mile tax.

Practical implications

-

If your fleet includes trucks operating in Oregon and their gross/combined weight exceeds 26,000 lbs, you’ll likely need to set up an account, declare the weight, keep mileage logs, and file tax reports.

-

The rate per mile varies depending on declared weight and configuration. For vehicles over 80,000 lbs, having additional axles may reduce the rate because the rate table accounts for damage per axle.

-

If you choose the flat fee option (where eligible), the tax burden becomes somewhat fixed/annual rather than mileage‑based — helpful if you do predictable operations.