Overview: What Is Oregon’s Weight-Mile Tax

-

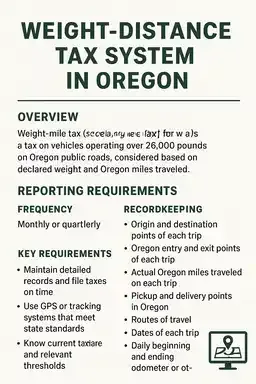

Oregon’s weight-mile tax (sometimes called “highway use tax” or “mileage tax”) applies to commercial vehicles operating on Oregon public roads with registered weight over 26,000 pounds.

-

It is based on two main factors:

-

Declared weight (or registered/permit-based weight). For heavier trucks, especially above certain thresholds (e.g. 80,000 pounds), different tax tables apply.

-

Oregon miles traveled (i.e. miles driven within Oregon) — including both loaded and empty travel, subject to how you declare configuration, weight, etc.

-

-

There is also a Road Use Assessment Fee (RUAF) which comes into play for non-divisible loads over certain weights (e.g. gross weights more than 98,000 pounds). For such loads, the RUAF replaces the weight-mile tax for the loaded portion.

Key Reporting / Recordkeeping Requirements

To comply, carriers must maintain detailed records and regularly file reports. Here are the specifics:

-

Which Reports, When, and How Often

-

Carriers with vehicles subject to the weight-mile tax must file monthly or quarterly mileage tax reports.

-

There’s a form for monthly mileage tax reporting (Form 9002) and a quarterly option (Form 9002t), plus continuation sheets where needed.

-

Carriers that qualify (based on history, compliance, etc.) can apply to switch from monthly to quarterly filing.

-

-

What Records Must Be Kept

Under Oregon Administrative Rule 740-055-0120, the “Weight-Mile Tax Records Requirements,” carriers are required to keep evidence including:

-

Origin and destination points of each trip.

-

Oregon entry and exit points of each trip.

-

Actual Oregon miles traveled on each trip.

-

Pickup and delivery points in Oregon.

-

Routes of travel.

-

Dates of each trip.

-

Daily beginning and ending odometer or other mileage-recording device readings for each vehicle.

-

-

Use of GPS / Tracking Systems

-

Oregon allows vehicle-tracking or GPS-based systems to be used in place of manual/traditional recordkeeping, provided the electronic records still satisfy all of the above requirements.

-

If using GPS or similar, the system must capture latitude & longitude to at least five decimal places, timestamps (date & time, at least every 15 minutes and when certain “significant events” occur, such as crossing state lines or turning engine on/off) to validate the mileage.

-

-

Special Rules for Heavier / Overweight or Permit Loads

-

Carriers with weights above certain thresholds (e.g. over 80,000 lbs) need to declare maximum operating weights for each vehicle configuration. Multiple configurations may require distinct declared weights.

-

If traveling with a configuration that requires a raised weight permit, or changes occur (e.g. configuration changes, actual loaded weight changes cross a threshold) then the tax rate and reporting must align with that declared weight/configuration.

-

For non-divisible loads exceeding certain weights, the RUAF applies instead of the normal weight-mile tax for the loaded portion.

-

-

Retention & Inspection

-

Records must be stored at the carrier’s principal place of business.

-

Records must be available for inspection by ODOT or its representatives.

-

Records must be retained for three years unless otherwise authorized.

-

Unique or Notable Features in Oregon vs Other States

-

Oregon’s system requires weight-specific declared weights per vehicle configuration. Some states just base tax on “class” or “registered weight,” but Oregon requires more precision, especially as configuration changes.

-

The RUAF for very heavy non-divisible loads is a special regime. Not all states have a similar fee / permit structure exclusively for non-divisible loads over very high weights.

-

The GPS / latitude-longitude requirement (with precise decimal places) and tight timestamping (every 15 minutes, and for certain events) is relatively strict compared to some states that may allow simpler odometer logs.

Penalties & Miscellaneous Requirements

-

Reports must be legible and readable; illegible or unreadable reports may be returned and treated as unfiled, possibly leading to penalties.

-

Late filing or late payment results in penalties (for example, 10% late fee if not post-marked by the deadline).

-

If the underlying data or supporting records are insufficient or missing (e.g. missing origin/destination, odometer readings, etc.), credits or claimed items may be disallowed during audits.

Practical Tips for Carriers Operating in Oregon

-

Always declare appropriate weight(s) for each configuration you use. If you run regularly with a trailer, drop-deck, etc., ensure you have declared weight for each.

-

Use GPS or electronic tracking tools that meet Oregon’s standards (coordinate precision; timestamping; capture state-entry/exit).

-

Maintain both physical backup (bills of lading, load tickets) and electronic records.

-

Make sure odometer / hubodometer readings are collected and stored for each trip.

-

Know when your reporting due dates are (monthly or quarterly). Don’t assume the same as other states.

-

If doing non-divisible loads over thresholds (98,000 lbs etc.), ensure you understand the RUAF regime (permits, fees, reporting).