What you should aim to do

-

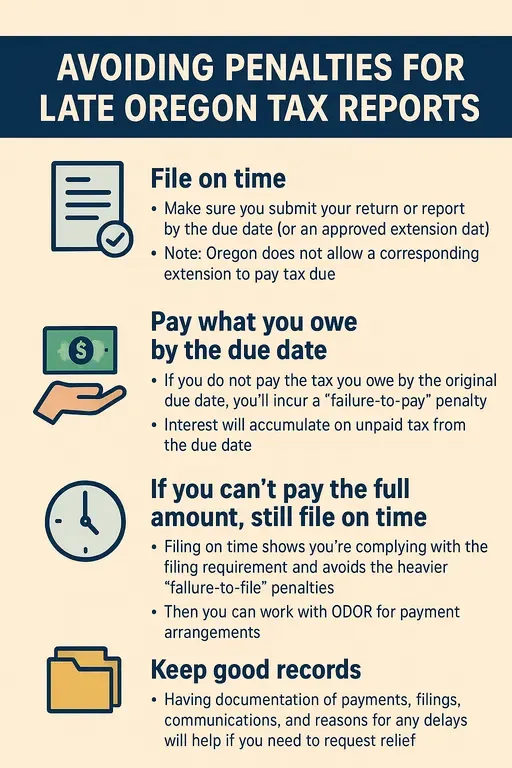

File on time

-

Make sure you submit your return or report by the due date (or an approved extension date) for the relevant tax program.

-

Note: Even if you get an extension for filing, Oregon does not allow a corresponding extension to pay tax due.

-

Late filing can trigger penalties even if you file the return later.

-

-

Pay what you owe by the due date

-

If you do not pay the tax you owe by the original due date, you’ll incur a “failure-to-pay” penalty.

-

Interest will accumulate on unpaid tax from the due date.

-

-

If you can’t pay the full amount, still file on time

-

Filing on time shows you’re complying with the filing requirement and avoids the heavier “failure‐to‐file” penalties.

-

Then you can work with ODOR for payment arrangements.

-

-

Keep good records

-

Having documentation of payments, filings, communications, and reasons for any delays will help if you need to request relief.

-

If you expect trouble meeting deadlines (e.g., due to illness, disaster, business disruption), document early and proactively.

-

What penalties you face for late filing or payment

Here are some of the penalties that apply under Oregon law:

-

A 5% penalty of the unpaid tax if you fail to file the return or pay the tax by the due date.

-

If you exceed three months past the due date (for an annual return) without filing, there’s an additional 20% penalty. So total could be 25%.

-

If you fail to file three consecutive years by the due dates, there is a 100% penalty of the tax deficiency.

-

Interest is applied on the unpaid tax at the current rate (for example 9% annually for periods beginning Jan 1 2025) plus additional interest if unpaid more than 60 days after assessment.

So: missing deadlines can lead to substantial extra cost.

How to request penalty relief (waiver / abatement)

If you missed a deadline, all is not lost — there are mechanisms for penalty relief, but you’ll need to act. Some key features:

-

ODOR allows penalty waivers for eligible penalties (failure‐to‐file, failure‐to‐pay, additional 20/25% penalties) when you show a valid reason.

-

Acceptable reasons (often called “reasonable cause”) include: serious illness/death, natural disaster or casualty destroying records, unavoidable absence, incorrect written departmental advice, etc.

-

Reliance on a professional to prepare the return is not by itself sufficient for waiver if the taxpayer was otherwise able to understand their obligations.

-

There is typically a one‐time waiver for a taxpayer with good prior compliance history even if they don’t meet the “beyond control” standard.

-

To apply: you submit a written request (via ODOR’s online “Revenue Online” portal or in writing), detailing your facts and attaching documentation. You’ll need to pay the tax (and interest) before they’ll waive the penalty.

Checklist if you’re late or foresee being late

-

File your return/report as soon as possible (even if payment isn’t ready).

-

Pay as much of the tax as you can when you file or shortly after.

-

If you cannot pay in full, contact ODOR about a payment plan to avoid further collection actions and interest accrual.

-

Review whether your situation might justify a penalty waiver (e.g., disaster, illness, system failure).

-

Gather supporting documents (medical records, correspondence, business interruption records, etc.).

-

File the waiver request timely according to ODOR rules.

-

Ensure you’re up to date with all required filings and payments for all tax programs — business taxes, withholding, estimated payments, etc. — because compliance history matters.

Example scenario

Let’s say an Oregon taxpayer fails to file their annual income tax return by the due date and also fails to pay the tax. Here’s how the penalty might work:

-

Tax owed: $10,000

-

Late filing by more than three months → 5% + 20% = 25% penalty = $2,500 plus interest.

-

If they wait a full year or more without filing, ODOR could assess the tax by “best information and belief” and then add the additional 25% penalty (making 50% total in some cases).

But if the taxpayer files and pays quickly once they realise the mistake, and applies for a waiver with good cause, the penalty could be reduced or eliminated.

Final thoughts

-

The best way to avoid penalties is to file and pay on time.

-

If you do miss a deadline, treat it urgently: file as soon as possible and contact the department about payment options.

-

Waivers are available, but depend on your facts and your compliance history — you’ll need to show a credible reason.

-

Interest is not generally waived, so the sooner you pay, the less interest accumulates.